The Foundation of Financial Control: Cash Flow

The first step to mastering your finances is understanding where your money goes. Every dollar flows in one of two directions—in or out—and most people only pay attention when more is going out than coming in. But true financial independence requires constant awareness and intentional management.

At DIY Wealth Education, we focus on three key habits: controlling spending, saving consistently, and being strategically frugal. Central to this is the Cash Flow Plan (CFP)—a practical, step-by-step system tailored to your lifestyle. It helps you identify how much you can save each month, spot out-of-line expenses, and build an emergency fund from within your existing income.

Cash flow is the engine of wealth accumulation. The CFP isn’t just a spreadsheet—it’s a roadmap to financial clarity and long-term independence. It’s the tool that helped me take control of my money, instead of letting it control me.

Sign up for your free Savings Ebook

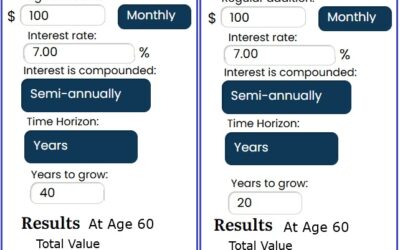

Why don’t young people invest?

I was talking with a couple of Mutual Fund Sales people the other day. One of them asked the question: Why is it so hard to get people to start investing? Especially younger (under 40) people who have the greatest investment tool there is TIME. I didn't have a good...

Dealing in Crypto. (without being Scammed)

There is a lot of talk about cryptocurrencies these days. I do not own any cryptocurrencies directly. I leave that to my sons. My oldest got into Bitcoin when it was under $10,000.00. He is the only person that I know personally, who has done well in direct Crypto...

Have things improved?? (Then/Now)

I was scrolling the other day when an ad from the Royal Bank popped up — all smiles and sunshine. It was aimed at newcomers to Canada, showing how the bank could help them settle in. The storyline was simple: you need a credit score to rent an apartment, you go to the...

ON SALE (but do you need it?)

I work with a fair number of younger people. Under 45. They have a tendency that I just can not figure out. Just because something is ON SALE does NOT mean that you have to BUY it!!!! I will give you two examples. One is my ex-son-in-law. (I still like the guy) It...

The Real Path to Wealth.

The Real Path to Wealth: It Starts with Cash Flow and Lifestyle No two financial situations are alike. Everyone has different goals, abilities, and circumstances—which makes building a personal financial plan both essential and challenging. The hardest part?...

Working or Playing the market.

I believe that there is a big difference between "PLAYING" the STOCK MARKET; and "WORKING" the STOCK MARKET. Over the last few months, I have switched from Playing to Working. It has made a large difference in my returns. The guy in the picture is "Playing" the...

Advice from a for profit website vs DIY

I check out the MSN Feed news every day. The main box has a mix of paid advertising and biased news clips. Some of the adverts are sponsored by companies paid to promote company stocks. Usually, one or more panels are from a FOR PROFIT stock advisor company. The...

Getting to Financial Independence

My students will tell you that my mantra in life is to “Think simple”. It was something one of my college professors always said, with a heavy French Canadian accent. He was one of the best teachers I ever had, and was an inspiration for me as a teacher. I have come...

Bad Grandpa??

I am a very bad grandpa. I admit it. I am also a fair bit of a Scrooge. Throw in Covid and you have the perfect storm. For the last several years I have tried to instill some financial sanity into the Christmas season. I have promoted a “small gift” for the kids,...

Do I have to work till I die??

I really got interested in finances when I was about 45 years old. I realized that there were not that many “Earning years” ahead of me. So, I looked at my financial situation with a view to retiring. It was not a pretty site. $50,000.00 in your RRSP is just not...