The Foundation of Financial Control: Cash Flow

The first step to mastering your finances is understanding where your money goes. Every dollar flows in one of two directions—in or out—and most people only pay attention when more is going out than coming in. But true financial independence requires constant awareness and intentional management.

At DIY Wealth Education, we focus on three key habits: controlling spending, saving consistently, and being strategically frugal. Central to this is the Cash Flow Plan (CFP)—a practical, step-by-step system tailored to your lifestyle. It helps you identify how much you can save each month, spot out-of-line expenses, and build an emergency fund from within your existing income.

Cash flow is the engine of wealth accumulation. The CFP isn’t just a spreadsheet—it’s a roadmap to financial clarity and long-term independence. It’s the tool that helped me take control of my money, instead of letting it control me.

Sign up for your free Savings Ebook

Wake up to Canada Canadians.

I was talking to someone the other day and we were comparing stories about American Patriotism examples. It got me thinking. Many Canadians have a poor opinion of American Patriotism. We think that it is over done. But is it?? Or does it just look that way,...

Change of topic

I get bored quick so today is a change of topic. Tomorrow I will publish the Bottom Feeder Picks for Thursday and Friday. Today I want to talk about the miss use of the word FREE and some other words of finance. According to the Merriam-Webster dictionary the...

It’s Too Bad.

Kevin O'Leary gave me some excellent advice. I had asked him about how to price a Financial Course. He told me, then said BUT! "No matter how good it is, even if you give it away for free, the people who really NEED it, will not take it." I will admit that I hoped...

There is life after disaster

The picture says it all. This is financial Disaster. This is the ultimate failure. That was the premise that I was raised under. Only "THOSE KINDS OF PEOPLE" allowed this to happen. According to Bankruptcy Canada there are 5 main causes of financial hardship. 1....

A not so pleasant Surprise.

After coming back from Vacation in the US this week, I went into my local Bank Branch. I have an account there that is called a "US Dollar Daily Interest Savings account." I am a very big fan of daily interest, paid monthly. That is like a credit card except that...

Help with a financial Plan

So, it is almost the new year. I am sure that many of you have resolved to do better with your finances this year. Please know that I am here to help where I can. Just ask. I too have some changes that need to be made. In November I did 6 web sessions with The Money...

Retirement. A different perspective.

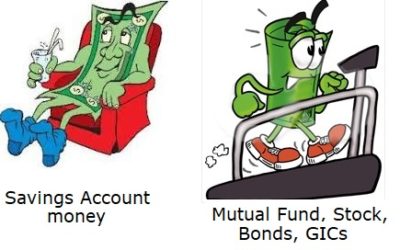

In Canada we are approaching RRSP season. When the financial institutions push us to make contributions to our retirement accounts. This yearly persuasion has established, for most people, only one way to finance their retirement. That is to have a very large sum of...

Changing Perspectives

We were visiting one of our friends yesterday after our exam. I played chauffeur for the ladies. Our friend is one of the best bargain hunters I know. In our family, when you get a smokin’ hot deal we call it an “Auntie Jane” deal in her honour. Our first stop was...

Knowledge can reduce stress

There were two stories on the news over the last week that caught my attention. One was on the number of Canadians that are financially illiterate, and the other was the amount of lost productivity in Canadian work places, due to employees being worried about their...

A good Quote

My daughter sent me a picture the other day of Robert Kiyosaki and a Rich Dad Quote. The quote said “it’s better to work years at creating an asset, rather than spending your life working hard for money, to create someone else’s asset.” It is a very true statement. ...