The Foundation of Financial Control: Cash Flow

The first step to mastering your finances is understanding where your money goes. Every dollar flows in one of two directions—in or out—and most people only pay attention when more is going out than coming in. But true financial independence requires constant awareness and intentional management.

At DIY Wealth Education, we focus on three key habits: controlling spending, saving consistently, and being strategically frugal. Central to this is the Cash Flow Plan (CFP)—a practical, step-by-step system tailored to your lifestyle. It helps you identify how much you can save each month, spot out-of-line expenses, and build an emergency fund from within your existing income.

Cash flow is the engine of wealth accumulation. The CFP isn’t just a spreadsheet—it’s a roadmap to financial clarity and long-term independence. It’s the tool that helped me take control of my money, instead of letting it control me.

Sign up for your free Savings Ebook

I’m not Ready for that yet.

That is the response I got when I suggested to a young friend that we sit down and look at getting started planning for the financial future. I totally understand and respect the response. It is exactly the same response I would have given when I was that age. The...

Too soon old and too late smart.

The title is something that my dad would always say. The worst part is that it is true. Too much of what we need to know about money and finance we learn way too late to take full advantage of. As you get older, you begin to see many of the financial advantages that...

Insurance. Really???

I recently wrote and passed my provincial license for Life Insurance. The course was very intense, and, very comprehensive. It was also not easy. I am sure that just like most people, insurance is not one of my favorite topics. It seems that we, as the policy...

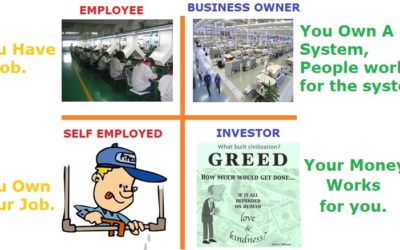

The 4 ways to make money

I was a meeting this week where the Cash Flow Quadrant came up. This is one of the most important financial concepts there is. This should be taught in schools. At my college, in the personal finance course, this never comes up. Understanding this diagram can mean...

Why would do you do that!?

This was the comment I got from a friend of mine the other day when I told him what I had done on the weekend. No, it wasn’t sky diving, or drag racing. I had written 6 hours of exams for Life Insurance. (They were qualification exams, not the Provincial Exam. That...

Financial Freedom. Monthly income or Lump Sum

At graduation last month I had a student ask me to describe the best was for them to get to financial freedom. That is a tricky question. The reason being, that the answer is dependent on a number of things. Age being one of the most important. If you are under 30...

Are you getting the Best Advice?

Is your financial Planner giving you the best advice FOR YOU? Or are they pushing a Fund that gets them a bonus this month. Do they have to have YOUR best interest foremost? Read on.

Can you SAVE your way to Wealth?

Saving is the cornerstone of Wealth Accumulation, but by it’s self it is not enough.

Rich or Poor, is there a choice?

One of the questions that eventually comes up in all my Basic Wealth Accumulation Courses deals with Rich VS Poor. We touch on this in the first section where we deal with a person’s beliefs. I ask questions around different beliefs about money and about...

Borrowing

A question that I asked a lot: “Is Borrowing always bad?” Read on