The Foundation of Financial Control: Cash Flow

The first step to mastering your finances is understanding where your money goes. Every dollar flows in one of two directions—in or out—and most people only pay attention when more is going out than coming in. But true financial independence requires constant awareness and intentional management.

At DIY Wealth Education, we focus on three key habits: controlling spending, saving consistently, and being strategically frugal. Central to this is the Cash Flow Plan (CFP)—a practical, step-by-step system tailored to your lifestyle. It helps you identify how much you can save each month, spot out-of-line expenses, and build an emergency fund from within your existing income.

Cash flow is the engine of wealth accumulation. The CFP isn’t just a spreadsheet—it’s a roadmap to financial clarity and long-term independence. It’s the tool that helped me take control of my money, instead of letting it control me.

Sign up for your free Savings Ebook

Can you SAVE your way to Wealth?

Saving is the cornerstone of Wealth Accumulation, but by it’s self it is not enough.

Rich or Poor, is there a choice?

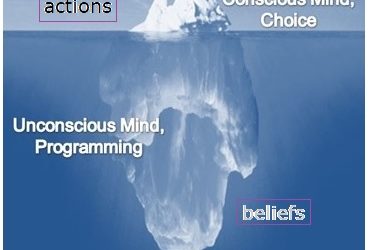

One of the questions that eventually comes up in all my Basic Wealth Accumulation Courses deals with Rich VS Poor. We touch on this in the first section where we deal with a person’s beliefs. I ask questions around different beliefs about money and about...

Borrowing

A question that I asked a lot: “Is Borrowing always bad?” Read on

Technology! How good is it??

Technology is everywhere. But is it really serving us? There is an old saying I believe. To error is human, to really screw up needs a computer. Read about my run in with technology.

Saving money in the real world.

Saving is the key to wealth accumulation. It is the seed that gets you going. Saving can be broken into two different areas. There is being “FRUGAL” and actually “PUTTING CASH AWAY”. Both of these are equally important. If you do both you...

Age and Investing

I was at an investing seminar put on by the local Credit Union this week. It as an after supper presentation so it wasn't all that long. There were a bunch of things that struck me as I was listening to the presenters and watching the audience. But there was a...

Belief and Money

I am starting another Wealth Accumulation course October 5th at Loyalist College in Belleville. Email me if you would like to attend. The first part of the course involves your beliefs. Most people think that beliefs are only for religion and faith. That is what...

What the Bible says

I recently finished teaching my Basic Wealth Accumulation course. The attendance was about the same as usual. I offered the course to over 30 people, and 6 accepted the offer and 3 completed the whole course. The age mix was also normal, near senior to early 20s. I...

Where I’m invested.

Some of the students from the last Wealth Accumulation Basics course, asked what they should invest in. I do not make specific investment recommendations. But I will tell you what I invest in and why. Being in the electrical field, I think that there is a big shift...

Making Money work for you.

Investors have a saying. Savers are Losers. That may not sound like it makes sense, but it is true. Saving is just the first step to wealth creation. Check out what comes next.