I check out the MSN Feed news every day. The main box has a mix of paid advertising and biased news clips. Some of the adverts are sponsored by companies paid to promote company stocks. Usually, one or more panels are from a FOR PROFIT stock advisor company. The one that caught my attention the other day was about the 4 dividend-paying Canadian Companies they say you should not be without.

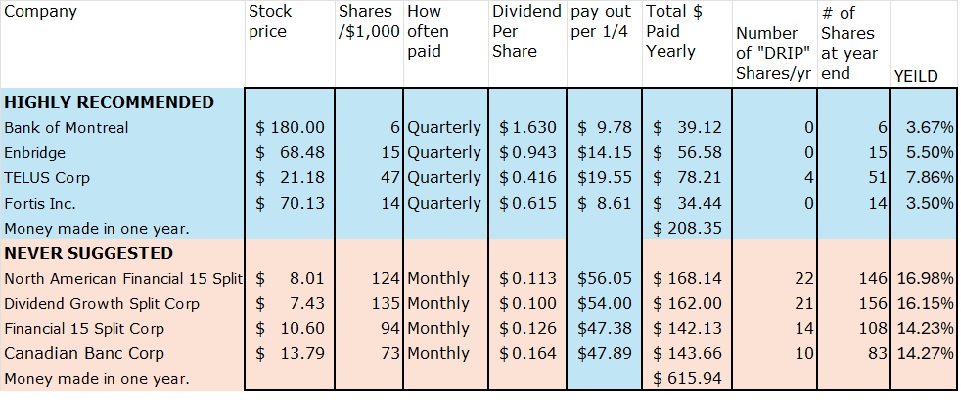

Here are the 4 Big Blue Chip stocks they recommended. Bank of Montreal (BMO), Enbridge (ENB), Telus (T) and Fortis Inc (FTS). They are pushing them because they have a good dividend. BMO’s dividend is $1.63 per share paid quarterly (paid once every 3 months). ENB’s is $0.943 per share paid quarterly. T’s is $0.416 per share paid quarterly. And lastly FTS’s is $0.615 per share paid quarterly. That sounds like a lot of money. And it is. But is that really the whole story??

When you start talking about dividends the term “YEILD” comes up. What is that?? Yield is basically a measure of the yearly dividend paid compared to the stock’s price. In very simple terms it is a little like interest on a Savings Account. The higher the Yield the better the investment. As with a Savings Account, the higher the interest the better. I have been told many times that you need to get at least a 6% yield to get ahead.

But there are a few of other important things about dividends. (1) How many shares can you afford to own? (2) How often is the dividend paid? (3) Do they offer a “DRIP” (Dividend ReInvestment Program). I’ll digress for a moment to explain what a DRIP is. When you get a dividend, instead of getting just money, you get extra shares. Here’s and example. You get $10.50 in dividends. The price of a share is $5.00. You would receive (DRIP) 2 extra shares plus $0.50 cash. This is a great way make more money. Because next month you have 2 more shares that you will get paid the dividend on. So you might get $10.95 the next month. This is a great way to dollar cost average as well.

The number of shares you own makes a big difference too. If you get a dividend of $0.10 per share and you own 10 shares, you would get $1.00. If you own 1000 shares you would get $100.00. So the number of shares that you own is a very big factor.

How often the dividend is paid is also very important. If the dividend is $0.10 and is paid quarterly you would get $0.40 a year per share. If the same dividend is paid monthly you would get $1.20 a year per share.

I deal mostly with small investors. People with between $500.00 and $5,000.00. They can not buy enough shares of big Blue Chip companies to make any money. So what do they do?? They go to my “Resources” page and scroll down to my Dividend tracking spreadsheets. There you will find more affordable dividend shares that actually pay out a higher Yield than the more expensive stocks. Here is a comparison.

The table speaks for its self. The more affordable stocks allow you to own more shares, pay out more often, and actually make the DRIP worth while. A dividend of $0.113 compared to a dividend of $1.63 looks terrible. But if you look at the money in your pocket at the end of the year, it looks a lot better.

I was talking with a retired friend of mine who is also an Investor. He was invested in large Blue Chip companies. I suggested that he was not making as high a yield as he could be. He didn’t believe me, till I showed him this chart.

This chart truly points out the importance of the number of shares you own, the frequency of payment, and the yield. It also demonstrates that the DRIP is Important. If you are using the money from your RRSP (RIFF if over 72) for retirement funding, the DRIP is not recommended. But if you are using your RRSP to grow investments, then I strongly advise using the DRIP.

So is the Motley advice from the “for profit” website the best advice for all?? Only you can decide.