I was talking with a couple of Mutual Fund Sales people the other day. One of them asked the question: Why is it so hard to get people to start investing? Especially younger (under 40) people who have the greatest investment tool there is TIME. I didn’t have a good answer, even though I was guilty of not investing sooner as well. I really didn’t get interested in my money till I was 42.

I figured I better ask something smarter than me. So I asked Co Pilot. Here is the answer I got. “People under 40 often struggle with investing because of (a) high living costs, (b) limited financial education, (c) mistrust of traditional markets, and (d) shifting priorities toward experiences and alternative assets.

I completely understand the High cost of Living. That is why my grand daughter and her kids are in my basement. Finding money to invest, or even just save, is tough. That is why I suggest you track your spending. I have never yet had a student who couldn’t find an extra $20.00 a month, once they understood where their money was really going. Yes $20.00 a month is a great start. I also put much of the blame on ADVERTISING. You can’t seem to get away from it. Advertising does a fantastic job of making WANTS look like NEEDS.

The “Limited financial education” of course caught my eye. When people are surveyed as to why they don’t invest, lack of financial knowledge is always in the top 3. It is the reason for this site. We used to get or education from our Parents, Banks and Mutual Fund companies. But how financially educated were our Parents? Mutual Funds are designed for never going down too much, and also never going up too much. They are the best choice, in my opinion, for those who want to invest and forget. Not what this site is about. I want you to be very smart about Finances!

Mistrust of institution makes sense as well. Canadian banks, charge a service fee for just about everything, even though in Q4 2025, “Canada’s Big Six banks (RBC, TD, Scotiabank, BMO, CIBC, National Bank) reported a combined net income of about C$16.5 billion, averaging roughly C$2.7 billion per bank for the quarter. Considering that most of us use online tools and not tellers for our banking, I think they could give customers some of those Billions of dollars in lower fees. Banks will never tell you anything wrong, they just don’t tell you what is really right. That is why I recommend using Credit Unions. Copilot also cited “Reliance on social media: Gen Z especially turns to influencers and apps for financial advice, which can be unreliable”. If it sounds too good to be true it isn’t real!

Priorities have shifted as well. Younger generations often value travel, social causes, and entrepreneurship more than traditional wealth accumulation. Today there are also alternative invests. Crypto, startups, and fractional real estate feel more tangible and exciting than stocks and mutual funds. Also many younger workers prioritize flexibility and independence, making traditional retirement planning less appealing. From experience, being independent is way easier if you have money.

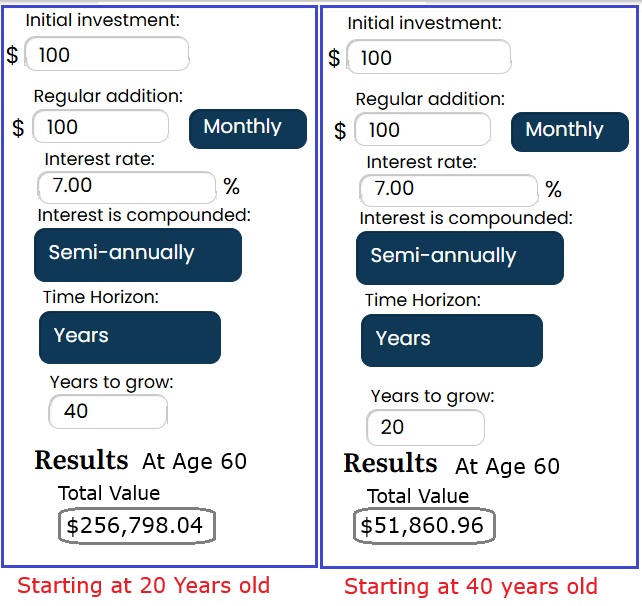

I am very pleased to see that younger people don’t see wealth accumulation as the highest priority in Life. That should be reserved for family and nature. BUT it should not be ignored!! Investing small amounts starting at age 20 will produce far greater results by age 60 that trying to invest large amounts after age 40. See the Picture.

Writing in Blue is copied from Copilot.