This past weeks Stock Scan Picks

These are my picks from this week.

A2 Gold Corp (AUAU) Is a Gold Resourse company with a large area in Nevada. It has 3 large projects in Nevada, and is backed by recent good gold grades and is backed by Kinross Gold.

Emerita Resources Corp (EMO). Is a mineral Resource company dealing in Spain. They had a recent court decision go against them so there is a knee jerk Selling. The ruling may not seriously affect the operation of the company. I bought them.

Trifecta Gold (TG) They have 3 very promising projects. They have very high gram /ton Silver assays on recent drilling. I bought them this week as well.

Minehub TechnologiesInc. (MHUB) They are a shipping and billing software company that signed a Memorandum of Understanding with a major player in the field. If it turns into a full contract it would be game changing.

ESGold Corp (ESAU) Is a Canadian Resource company that is advancing their Quebec Flagship project towards production.

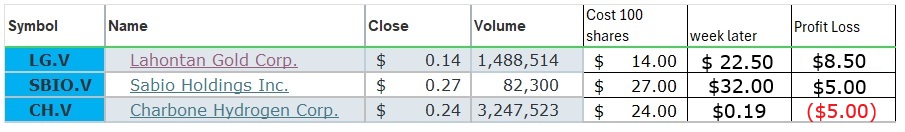

The Results for last Weeks Picks

Here are the results from the week of Dec 22 stock picks. I only picked two winners. But we made money again this week. we are entering “Tax Loss Season”, So the market may be a bit more choppy this month.

Since I am a Micro Investor my scans check for stocks less than $25.00. I scan the TSX, Venture, and CSE exchanges.

THIS IS NOT A RECOMMENDATION TO BUY!!!

Comments

Lahontan Gold Corp (LG) Went up 8.5 cents. That might not seen like a lot, but it is a 60% increase in price. Not a bad return.

Sabio Holdings Inc (SBIO) Went up 5 cents. This an 18% increase. I think it will go up more in the longer term.

Charbone Hydrogen Corp (CH) Went down 5 cents. Not a huge drop, and fairly normal for a less liquid stock. It might take a while for the market to catch up with the news it is now a producer not just an explorer.

Who is looking after your money??

I doubt there there has ever been a time where there are more people out there talking about money. I guess that includes me. I get at least half a dozen emails a day from investment sites that are just dying to tell me how to get the most from my money. They have...

Its Canadian RRSP season. Know what your getting into.

Its RRSP (401K) Season again. Just a little info to go along with all the hype at this time of year.

Working with a Credit Union.

Banks Vs Credit Unions. A very unfair advantage is given to the Banks. Yet Credit Unions are definitely a better bet for the average Canadian. Read why.

Could somebody explain this??

I did something this week that I have not done in a long time. I went shopping with my wife, mother-in-law (mom) and my sister-in-law. I went because they needed a driver, due to the snowy roads. The trip reminded me why I don't spend much time in Shopping malls. ...

Stocks this week.

We finally got back to class, so things are busy. The market is moving quickly too. Here is a recap of what I have been doing.

Basics of using Stock Charts

Reading Stock charts (Technical Analysis) looks hard at the beginning. To many graphs and lines. But there sre some basic places to start, This is one of them.

In my spare time.

Finding Stocks to Buy can be a challenge. New investors often don’t know where to start. Here are some suggestions.

Update on Roll the Dice

I figured you might want to know the outcome of the stock story in Roll the Dice. Well here it is. I sold the stock last Friday for $1.84/share. The stock gods were smiling on me. Here it is Thursday morning and the stock is opening at $0.0685. That is less than...

Some times you just have to roll the dice.

You get a hot stock tip. What should you do? Here is what I did and how it turned out.

Choosing an Online Trading Platform

The first step in Portfolio Investing is the Online Trading Account. Here is some basic information.

REITS or Real Estate Investment Trusts

Real Estate is one of the three ways that a person can become wealthy. The other two are Investing (Stocks, Bonds, ETFs, Mutual Funds, etc) and owning your own business. Real Estate seems to be quite popular at the moment. There are dozens of TV shows about flipping...

Basics of Micro Investing.

Want to do Stock Investing but feel you don’t have enough money? Then you might be a Micro Investor. Read on to see how it is done.

Why buy a Dividend paying Stock?

Not getting any interest on your savings at the bank? Why not check out Dividend paying stocks. Don’t know what that is? Read on McDuff.

Some Basic Stock Info BEFORE you buy

Ever wondered if you should invest in stocks?? If so start your education with this article. There is more to it, but this is just one of the articles that will be featured here.

Different ways of judging stock value

The theory is simple. Buy low Sell high. But what price is low, and what price is high? Is there a way to figure this out? Sure is.

Blue Chip vs Penny Stocks and Micro Investing

Financial Planners will tell you that Investments of less than $10,000.00 are better off in a Mutual Fund. Is that the only choice?? No. With practice and knowledge you can benefit from stocks too. Read on for more info.

Definition of a Micro Investor

The Bank/ Financial Advisor tells you that since you only have $500.00 you need to invest in Mutual Funds not the Stock Market. The Market is too complicated, and you need thousands to enter the Market. If you want to build Wealth and are really interested in YOUR money, is that really the only way?